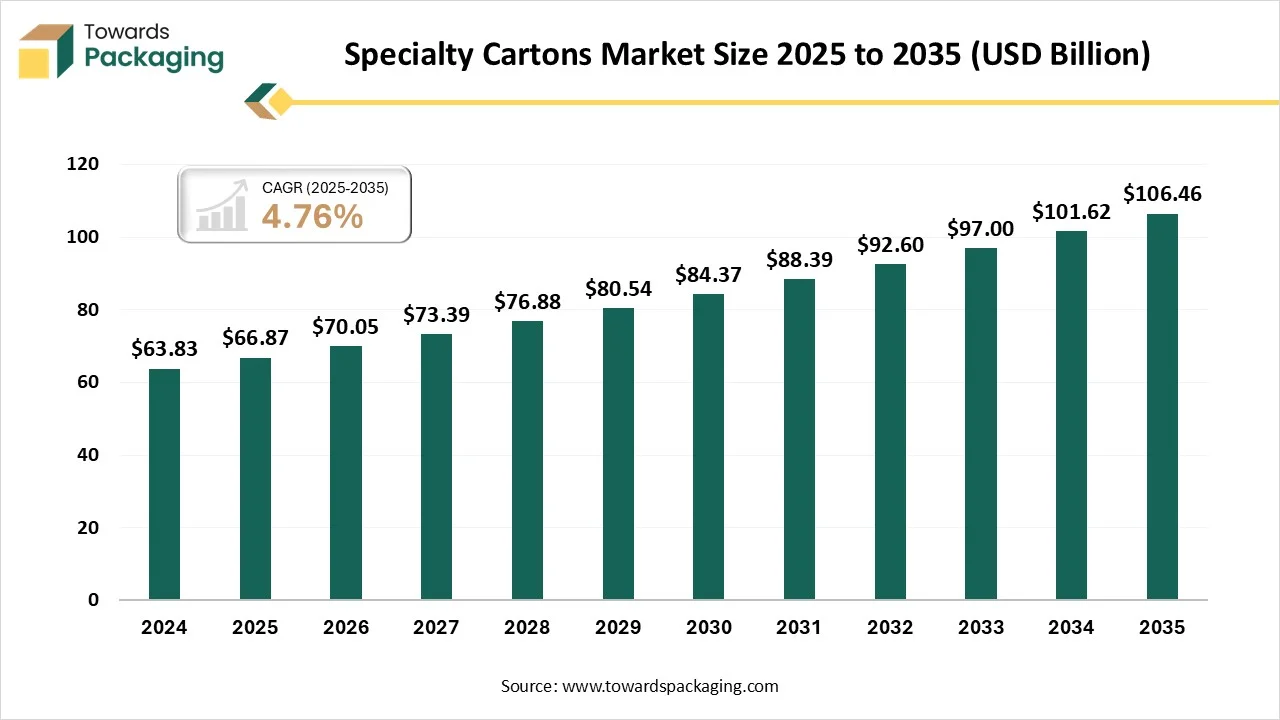

Ottawa, Feb. 06, 2026 (GLOBE NEWSWIRE) -- The global specialty cartons market hit USD 66.87 billion in 2025, with current forecasts pointing to USD 106.46 billion by 2035, according to Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Specialty Cartons?

Specialty cartons refer to custom-designed, premium paperboard packaging solutions that go beyond standard folding cartons to offer enhanced visual appeal, structural innovation, and advanced functional features. They are meticulously crafted to enhance branding, protect high-end or niche products, and provide a memorable, "showstopper" unboxing experience for consumers.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5943

Private Industry Investments for Specialty Cartons:

- SIG Indian Plant Expansion: Global provider SIG is investing $43.29 million in February 2025 to increase capacity at its Ahmedabad-based plant, targeting India as a primary growth market for aseptic carton solutions.

- WestRock Southeast Asia Expansion: WestRock completed a major capacity expansion in May 2025 by investing in advanced digital printing and converting technology to provide customized, short-run specialty folding cartons.

- BHS Pune Manufacturing Plant: BHS invested over ₹200 crore ($24M+) in a new 5-acre facility in Pune, India, specifically to install advanced flexo printers and folder gluers for high-quality "square" corrugated boxes by early 2025.

- SIG Querétaro Facility Growth: In July 2025, SIG announced a $35 million expansion of its state-of-the-art carton plant in Mexico to reinforce its long-term supply commitment to the North and Central American markets.

- Smurfit Westrock Cross-Regional Merger: Following their massive cross-regional merger, the newly formed Smurfit Westrock reported net sales of $7.94 billion in Q2 2025, leveraging their combined scale to dominate the global specialty carton market.

- Stora Enso Oulu Consumer Board Line: Stora Enso continues multi-year capital investment in its Oulu production line, confirming in early 2025 that the facility is on track to reach full capacity for consumer board production by 2027.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

What Are the Latest Key Trends in the Specialty Cartons Market?

- Sustainability and Plastic Replacement: Stricter regulations and consumer demand for eco-friendly options are pushing brands to adopt fiber-based, biodegradable, and compostable packaging.

- E-commerce and Right-Sizing: The surge in online shopping demands protective, durable, and efficiently sized (right-sized) packaging to reduce shipping costs and material waste.

- Premiumization and High-Graphics: High-quality, customized graphics, embossing, and specialized finishes (such as for luxury cosmetics and alcohol) are on the rise to enhance the unboxing experience.

What is the Potential Growth Rate of the Specialty Cartons Industry?

The specialty cartons industry is primarily driven by the intensifying global shift toward sustainable, fiber-based, and eco-friendly packaging solutions, spurred by environmental regulations and corporate ESG goals. Key drivers that support growth include the booming e-commerce sector requiring durable, customized, and brand-enhancing packaging, along with rapid growth in the food, beverage, and pharmaceutical industries.

Regional Analysis:

Who is the leader in the Specialty Cartons Market?

Asia Pacific dominated the global market by holding the highest market share in 2025, due to expanding consumer goods production, rising urbanization, and rapid growth of organized retail and e-commerce. Demand for cost-effective yet high-performance carton packaging is increasing across food, electronics, pharmaceuticals, and personal care sectors. Industrialization, population growth, and improving packaging standards contribute to strong demand, particularly in emerging economies investing in modern packaging infrastructure.

India Specialty Cartons Market Growth Trends

India dominates the region owing to its large manufacturing base and growing domestic consumption. The country’s strong e-commerce ecosystem drives demand for durable and customized carton packaging. Additionally, food processing, electronics, and pharmaceutical industries significantly contribute to the rising need for specialty cartons, supported by advancements in printing, converting, and sustainable packaging materials.

How Did North America Expect to Experience Growth in the Specialty Cartons Market?

North America is expected to grow at the fastest rate in the forecast period, supported by strong demand from the food & beverage, pharmaceuticals, personal care, and e-commerce sectors. Sustainability regulations and consumer preference for recyclable, fiber-based packaging are accelerating the shift from plastics to advanced paperboard cartons. Growth in premium packaging, smart labeling, and protective carton designs for online retail further strengthens regional demand, while automation in packaging lines supports large-scale carton production.

Canada Specialty Cartons Market Growth Trends

Canada dominates the North American market due to its vast consumer goods industry and advanced retail ecosystem. Strong demand for sustainable packaging, high-value folding cartons, and custom-printed solutions supports market expansion. The country’s developed food processing, healthcare, and cosmetics industries rely heavily on specialty cartons for branding, protection, and regulatory compliance, while e-commerce growth continues to drive innovation in durable and lightweight carton formats.

More Insights of Towards Packaging:

- Packaging Laminates Market Size, Trends and Competitive Landscape (2026–2035)

- Food Service Packaging Market by Product, End-User, Region, and Key Manufacturers, Competitive Dynamics and Trends

- Single-use Packaging Market Size, Segments, and Regional Dynamics (North America, Europe, APAC, LA, MEA)

- Bio-based PET Container Market Size, Trends and Regional Analysis (2026–2035)

- Paper-Based Pouch Packaging Machines Market Size, Trends and Regional Analysis (2026–2035)

- Dispenser Pump Market Size, Trends and Segments (2026–2035)

- Plastic Caps Market Size and Segments Outlook (2026–2035)

- Agriculture Chemical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Industrial Packaging Recycling Services Market Size and Segments Outlook (2026–2035)

- Europe Recyclable Packaging Market Size and Segments Outlook (2026–2035)

- Europe End-of-Line Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Corrugated and Folding Carton Packaging Market Size and Segments Outlook (2026–2035)

- Offset Printing Market Size, Trends and Segments (2026–2035)

- Post-Consumer Recycled Plastic Market Size, Trends and Regional Analysis (2026–2035)

- UV-Resistant Films Market Size, Trends and Segments (2026–2035)

- Cellulose Film Packaging Market Size and Segments Outlook (2026–2035)

- North America Corrugated Packaging Market Size, Trends and Segments (2026–2035)

- Uncoated Recycled Paperboard Market Size, Trends and Competitive Landscape (2026–2035)

- Radioactive Material Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Solutions Market Size, Trends and Regional Analysis (2026–2035)

Segment Outlook

Carton Type

How Did the Folding Cartons Segment Dominate the Specialty Cartons Market?

The folding cartons segment dominated the market in 2025, due to their lightweight structure, cost efficiency, and strong printability for branding and product differentiation. These cartons are widely used in food, pharmaceuticals, personal care, and consumer goods packaging. Their ability to support sustainable materials and recyclable formats aligns with global packaging regulations and consumer preferences for eco-friendly solutions, further accelerating adoption across retail-driven industries.

The rigid cartons segment is expected to experience significant growth in the market in the forecast period, as they are preferred for premium and luxury packaging applications where durability, structural strength, and high-end presentation are essential. These cartons are commonly used for cosmetics, electronics, confectionery, and specialty food products. Their thicker construction enables better product protection and supports advanced finishing techniques such as embossing and foil stamping. Rising demand for premiumization and luxury packaging experiences continues to drive growth in this segment.

Material Type

Which Material Type Segment Dominates the Specialty Cartons Market?

The solid bleached sulfate (SBS) segment dominated the market in 2025, due to its superior surface smoothness, brightness, and excellent printing quality. It is particularly suitable for food, pharmaceutical, and cosmetic packaging where visual appeal and hygiene standards are critical. The material’s stiffness and moisture resistance make it ideal for high-end applications, while regulatory approvals for direct food contact further strengthen its demand in the packaging industry.

The recycled paperboard segment is expected to experience significant growth in the market in the forecast period, as it is gaining strong traction as sustainability becomes a key purchasing factor for brands and consumers. It offers cost advantages and a lower environmental impact compared to virgin fiber materials.

Widely used in secondary packaging and consumer goods, recycled paperboard supports circular economy initiatives. Advancements in processing technologies are improving its strength and printability, expanding its use in higher-value specialty carton applications.

End-User Industry

Which End User Industry Segment Dominates the Specialty Cartons Market?

The food and beverage segment dominated the market in 2025, driven by rising demand for packaged foods, convenience meals, and branded retail products. Cartons provide effective barrier properties, product protection, and shelf appeal. Regulatory compliance for food safety, coupled with the shift toward sustainable and recyclable packaging formats, continues to strengthen the adoption of specialty cartons in this sector.

The cosmetics and personal care segment is expected to experience significant growth in the market in the forecast period, as brands rely heavily on specialty cartons for product differentiation, brand storytelling, and premium visual appeal. These cartons are used for perfumes, skincare products, and beauty accessories, where packaging aesthetics significantly influence consumer purchasing decisions.

The rise of luxury beauty segments and e-commerce-ready packaging solutions further drives demand for innovative carton designs with enhanced durability and decorative features.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Developments in the Specialty Carton Industry:

In September 2025, Mondi introduced white ink for its six-color digital printing capabilities for corrugated packaging to meet demand for high-contrast branding on brown substrates. Key features include a white underprint for vibrant colors, halftone capabilities for complex effects, water-based food-safe inks, and the elimination of printing plates for faster design changes.

Top Companies in the Specialty Cartons Market & Their Offerings:

- WestRock Company: Offers high-end cartons with decorative finishes like foils and holograms for luxury and healthcare brands.

- Smurfit Kappa Group: Focuses on bespoke folding cartons and shelf-ready packaging with high-impact retail designs.

- Amcor plc: Specializes in "Specialty Cartons" featuring sensory effects like tactile inks and prismatic finishes for premium goods.

- DS Smith Plc: Provides customized cartons with functional features like child-resistant closures and anti-counterfeiting tech.

- Mondi Group: Delivers high-performance barrier cartons designed to replace plastic in food and liquid applications.

- International Paper: Supplies high-graphics corrugated cartons and retail displays engineered for durability and print quality.

- Graphic Packaging International: Produces specialized multipacks and litho-laminated cartons for the personal care and healthcare sectors.

- Huhtamaki Oyj: Focuses on fiber-based specialty cartons with high hygiene standards for the foodservice industry.

Segment Covered in the Report

By Carton Type

- Folding Cartons

- Straight tuck end cartons

- Reverse tuck end cartons

- Auto-lock bottom cartons

- Crash-lock cartons

- Rigid Cartons

- Set up boxes

- Lift-off lid rigid cartons

- Magnetic closure cartons

- Shoulder & neck rigid cartons

- Hinged-Lid Cartons

- Flip-top cartons

- Hinged rigid boxes

- Book-style cartons

- Sleeve Cartons

- Full sleeve cartons

- Partial sleeve cartons

- Inner & outer sleeve packaging

- Window Cartons

- PVC window cartons

- PET window cartons

- Cellulose-based window cartons

- Die-Cut Cartons

- Precision die-cut cartons

- Custom insert die-cut cartons

- Structural die-cut display cartons

- Custom-Shaped Cartons

- Non-rectangular cartons

- Premium designer cartons

- Brand-specific structural designs

By Material Type

- Solid Bleached Sulfate (SBS)

- Virgin SBS board

- Coated SBS board

- High-brightness SBS

- Solid Unbleached Sulfate (SUS)

- Natural brown SUS

- Coated SUS

- High-strength SUS

- Coated Unbleached Kraft (CUK)

- Clay-coated CUK

- High-bulk CUK

- Moisture-resistant CUK

- Folding Boxboard (FBB)

- Multi-layer FBB

- High-stiffness FBB

- Lightweight FBB

- Recycled Paperboard

- Post-consumer recycled board

- Post-industrial recycled board

- Blended recycled board

- Corrugated Paperboard (Micro-Flute)

- E-flute cartons

- F-flute cartons

- N-flute cartons

By End-Use Industry

- Food & Beverage

- Pharmaceuticals & Healthcare

- Cosmetics & Personal Care

- Electronics & Electricals

- Tobacco

- Luxury goods & gift packaging

- Consumer goods

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5943

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Middle East Compostable Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- IoT-Enabled Packaging Market Size, Trends and Segments (2026–2035)

- Blockchain Technology in Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Sustainable Films for Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Industrial Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Bimodal HDPE Market Size, Trends and Competitive Landscape (2026–2035)

- Industrial Bulk Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Cling Films Market Size and Segments Outlook (2026–2035)

- Reusable E-Commerce Packaging Market Size, Trends and Segments (2026–2035)

- NFC-Embedded Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Circular Packaging Market Size, Share, Trends, Segmentation, and Regional Analysis 2025-2035

- Polyhydroxyalkanoates Films Market Size, Trends and Regional Analysis (2026–2035)

- PFAS-Free Food Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Carbon-Negative Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Plant-Based Plastics Market Size, Trends and Regional Analysis (2026–2035)

- 3D Printed Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Recycled Polyethylene Terephthalate (rPET) Market Size and Segments Outlook (2026–2035)

- Polyvinyl Chloride Packaging Film Market Size and Segments Outlook (2026–2035)

- Microplastic Recycling Market Size, Trends and Segments (2026–2035)

- Recycled Polypropylene in Packaging Market Size, Trends and Regional Analysis (2026–2035)